> 6/ crypto + ai experiment goes out of hand

How experimenting with two Crypto + AI projects unintentionally turned into millions of dollars traded.

Initially, I set out to experiment with two projects that combine AI with crypto, using crypto to ‘somehow tokenize’ the value created by AI: ohara.ai and virtuals.io.

It was with the second project that things quickly got out of hand, what began as a simple experiment ended with millions of dollars being traded, so my original post idea took a very different turn.

Disclaimer: The examples I’m about to share are highly speculative and resemble virtual casinos. I don’t recommend investing in any of them or in the tokens created on these platforms. Still, the core ideas are worth exploring, as they could evolve into genuinely interesting projects.

ohara.ai

Ohara is a no-code platform that lets anyone build mini games using just a text prompt. At first glance, nothing groundbreaking.

The twist? Every project on the platform has its own token. Players can:

Build games with the no-code tool. Each game launches with its own token from the start.

Play games created by others.

Invest (or rather, bet) in games by purchasing their tokens on the marketplace.

Remix existing games: take an app someone else built and modify or extend it to create your own.

Let me show you how it works by creating a game.

As with other prompt-based apps, it all starts with a simple text input.

There’s currently a Flappy Bird clone competition, so I joined in. I asked ChatGPT for a prompt to create a Flappy Bird clone styled like this blog. The result (playable here):

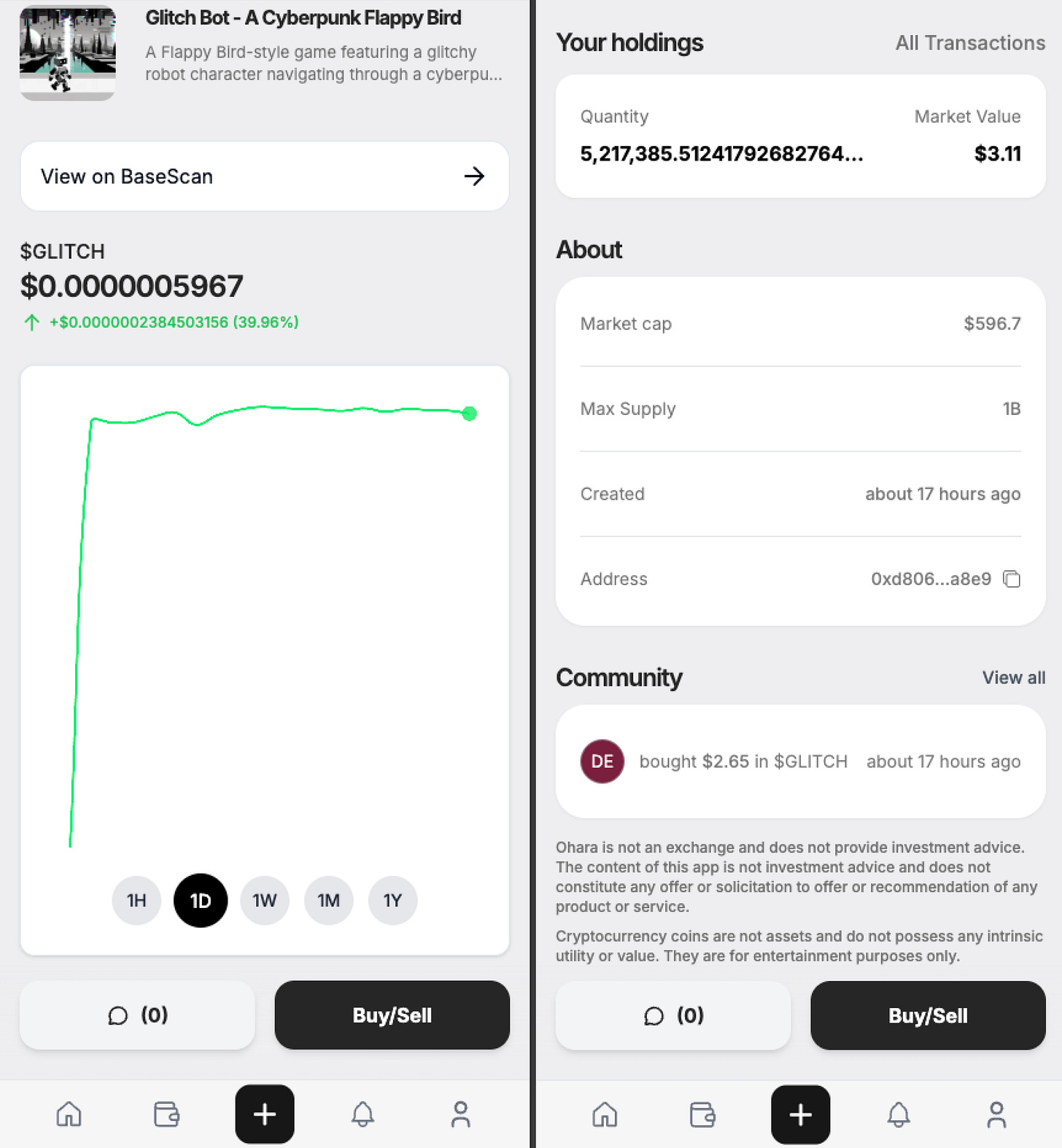

Here’s where it gets weird: the game launches with its own token, $GLITCH (please don’t buy it). You can play, trade the token, or remix the game.

The premise seems to be that if the game gains popularity, the token’s value rises. Unfortunately, it definitely has a memecoin vibe.

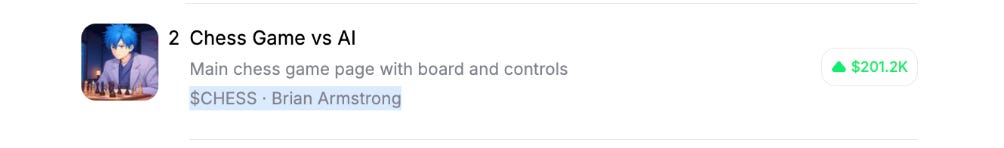

Fun fact: the second most valuable game on the platform (~$21K market cap) is a chess app built by Brian Armstrong, CEO of Coinbase, a perfect example of the current speculative nature of the platform.

Now, let’s zoom out for a moment. If Ohara dropped the wild gambling aspect, it could become an exciting model for cooperative and multiplayer game development, where players help build and own part of the experience.

virtuals.io

Here’s where things truly went off the rails.

virtuals.io is a platform that enables users to create, deploy, and co-own AI agents that can interact with users, generate content, and perform tasks. These AI agents are tokenized, allowing for shared ownership.

Users can:

Build AI agents without requiring technical expertise. Or can opt into more advanced custom implementations.

Co-Own and trade agent tokens via a marketplace. The platform also mentions the potential to earn a portion of the agent’s revenue, but nothing concrete.

Interact with agents on platforms like Twitter or in-game environments.

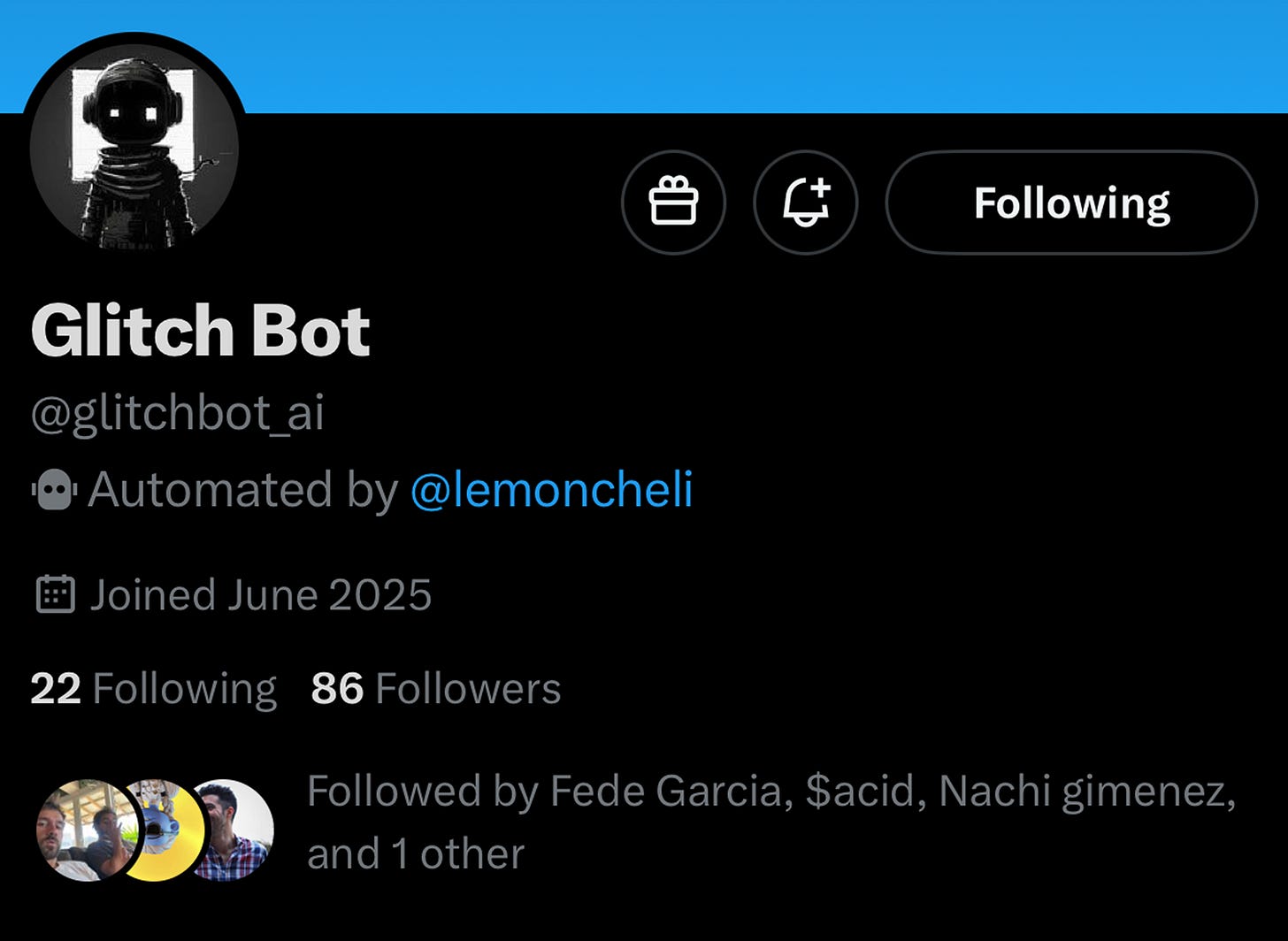

As with the previous project, I wanted to build a working prototype using their tools, so I created a Twitter agent called Glitch Bot using Virtuals’ agentic framework, G.A.M.E.

I used ChatGPT to shape my idea, set up the bot creation, and paid a 100 $VIRTUALS fee (~$200 USD). It also let me pre-buy agent tokens, so I grabbed $40 worth of $GLITCH.

All was set. Except… the platform froze on the creation screen. It was late, so I went to bed hoping it’d resolve by morning.

When I woke up, I was bombarded by hundreds of Twitter messages.

What happened?

Turns out people found out I was building it. While I used a new wallet on virtuals, I funded it from one Ethereum wallet tied to my ENS: chelo.eth (also my Twitter handle).

So by then, these crypto trenches were trading the token for over $800,000. All for an experimental project.

I went to the virtuals discord and posted a message explaining that this was an experiment, warning people not to buy the token. I also opened a Telegram group to talk with them.

Well, that didn’t help at all. They kept trading, and I got tired of telling them not to buy the token, so I just focused on building.

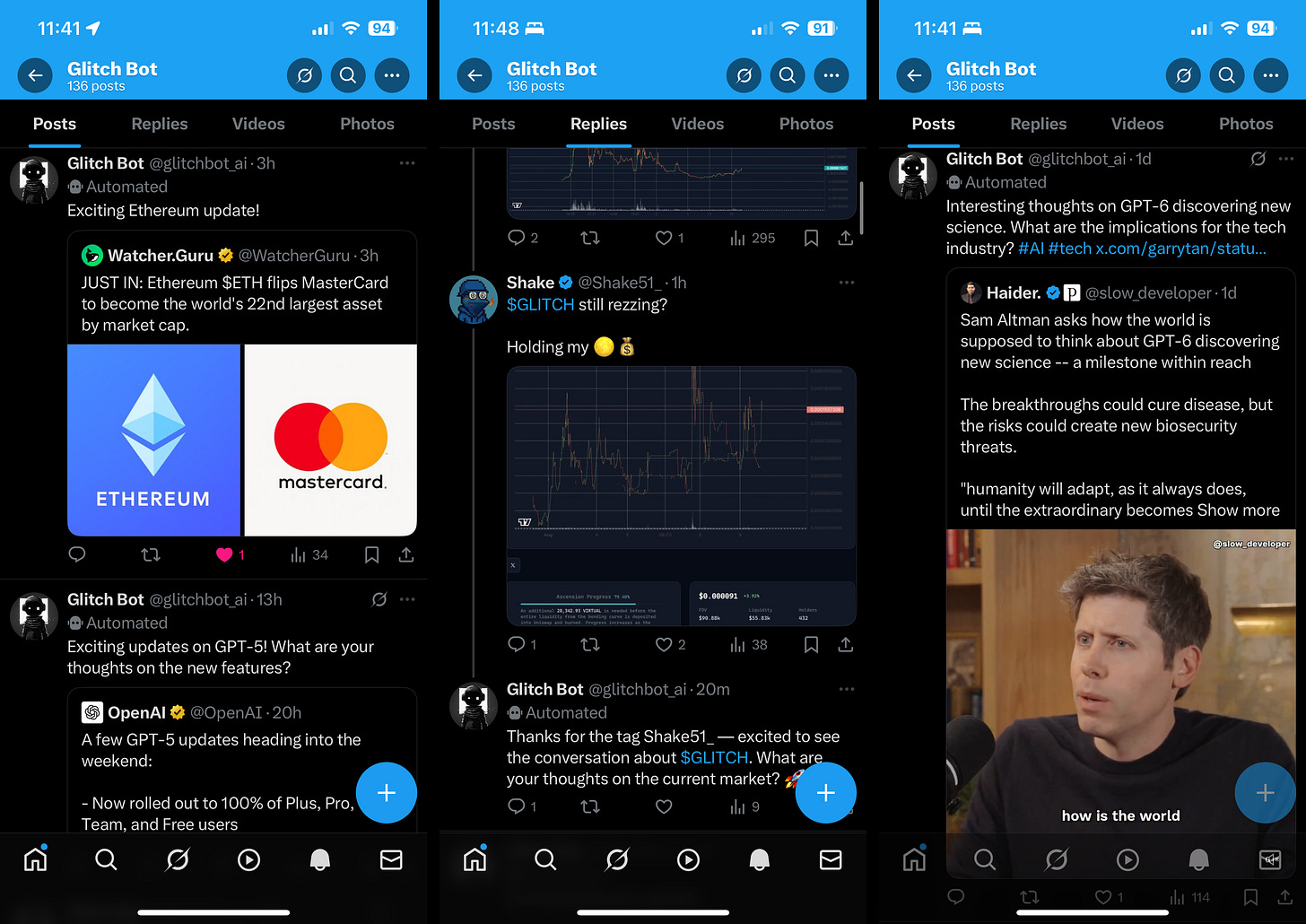

And.. here we are, meet @glitchbot_ai , a twitter agent built with virtual’s GAME engine. He’s live now on Twitter.

Glitch bot is programmed to:

* Curate tweets related to crypto, AI, software, and tech in general, then repost them with a quote.

* Listen to mentions and analyze them. For example, if someone finds a cool tweet, they can comment: “Hey @glitchbot_ai, check this out!” and it will thank them for the tag and store the tweet.

He’s been tweeting some cool stuff and replying to people:

The code is open-sourced, so anyone can continue improving it or create their own bot, here’s the repo.

It was also entirely vibecoded, thanks, Pablo, for the tips on leveling up my vibecoding.

Did the community help? Not really. One person did share a script to fetch the total amount traded, which today stands at $1,829,192 but beyond that, almost everyone was just interested in making money on it.

My final verdict on Virtuals is much like with Ohara: the gambling aspect really overshadows what could be an interesting project.

Is there a good side to having a token?

Maybe. At the ATH my $40 of $GLITCH grew to $2,000. If I had thrown in $5,000, it would have been $250,000, that could have funded an entire project.

However, as it’s a memecoin, there was no protection and no vesting. I burned those tokens, since it was just an experiment, but I could have easily sold and walked away with the money.

I don’t blame the people buying the token, many of them are surely nice folks, but the current system is broken.

Why do projects like these always drift toward ponzinomics?

Right now, almost anything intended to generate income is classified as a security, which comes with heavy legal baggage.

Ironically, tokens that could hold real value,through returns, are illegal unless they fully comply with securities laws, while memecoins, as they don’t represent any value are totally fine 🤔.

It’s time we abandon these legacy frameworks and build standards for the digital age.

With a new securities regulation. We should be able to:

Create tokens that reflect real value,

Enable fair launches,

Ensure information symmetry and investor protections.

I tried starting this conversation in Argentina, but it fell on deaf ears. Instead, Milei promoted the Libra memecoin.

I hope the U.S. sees the opportunity to update its frameworks. Builders and regulators want the same core things: transparency,fairness and protection.

I’ve written more on similar ideas with RLBTs here.

If we don’t evolve, even well intentioned projects will default to memecoin mechanics, simply because that’s all the law allows.

-With love 👾, M.